Your Social Security Number (SSN) isn’t just a random series of numbers; it plays a vital role in your life. Originally created to track workers’ earnings and help manage Social Security benefits, the SSN has grown into a key part of identification in the U.S. Today, it’s used in everything from job applications and tax filings to credit checks and government services. Introduced in the 1930s during the Great Depression, the SSN brought structure to a chaotic system and has continued to evolve over the years.

Each part of the nine-digit number has a specific purpose. While its original format helped identify a person’s location and manage records more efficiently, SSNs are now assigned randomly to enhance privacy and security. However, this widespread use also makes it a target for identity theft. That’s why understanding how your SSN works and how to keep it safe, is more important than ever.

How the Social Security Number Came to Be

The Social Security Number was introduced in 1936 as part of President Franklin D. Roosevelt’s Social Security Act. Back then, it was simply meant to track how much workers earned so the government could calculate retirement and disability benefits. But as the years went on, the SSN became a convenient way to identify people for other official purposes as well.

What started as a retirement benefits tool is now a primary ID number used across banks, hospitals, colleges, and nearly every government department. Over time, this nine-digit code has become essential for anyone living and working in the United States.

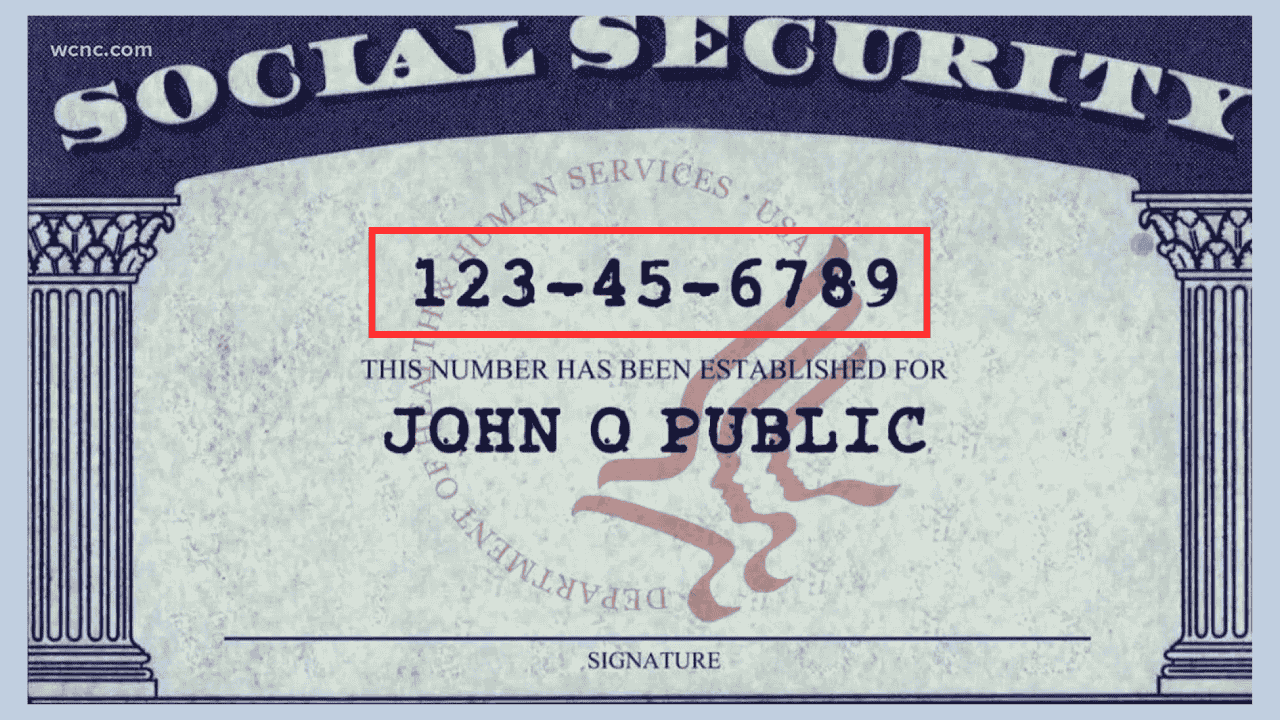

Understanding the 3-Part Structure of Your SSN

A Social Security Number follows this format: XXX-XX-XXXX. Each part serves a specific purpose.

1. Area Number (First 3 digits): Originally, this section indicated where a person applied for their SSN. For example, Vermont had numbers starting with 008–009, and Massachusetts had 010–034. Lower numbers were typically issued in the East, with higher ones in the West. But since 2011, this location-based system has been replaced by random assignments to enhance privacy.

2. Group Number (Middle 2 digits): These two digits helped break down the Area Numbers into smaller sets. This made issuing SSNs more organized and helped prevent certain regions from running out of available numbers. They were mostly administrative and don’t carry any personal details.

3. Serial Number (Last 4 digits): These are assigned sequentially within each group. They’re used to make each SSN unique, even for people from the same area. The serial number itself doesn’t reveal anything specific about the individual.

Why the SSN Is So Widely Used Today

Today, your SSN is needed for nearly everything; starting a job, filing taxes, opening a bank account, applying for loans, or getting health insurance. Employers report your income to the IRS using your SSN, and credit agencies use it to track your financial history.

Because of its widespread use, the SSN has become a high-value target for identity thieves. It doesn’t rely on fingerprints or facial scans for verification, just a number on a document. That makes it easier to misuse if it falls into the wrong hands.

The Growing Risk of Identity Theft

The rise in identity theft in the U.S. is closely tied to SSNs. According to the Bureau of Justice Statistics, around 23.9 million people aged 16 and older were victims of identity theft in just one year. That’s nearly 1 in 10 Americans. Even more alarming; about 1 in 5 have faced identity theft at some point in their lives.

SSNs are often stolen through phishing scams, data breaches, or lost wallets. Once someone has access to your number, they can open bank accounts, apply for loans, or even file tax returns in your name.

How to Protect Your Social Security Number

Keeping your SSN safe is crucial. Here are some basic steps you can take to reduce the risk of misuse:

- Memorize your number instead of carrying your SSN card around.

- Avoid sharing it online or over email. If it’s absolutely necessary, share it in person or through a secure channel.

- Don’t use your SSN as a login ID or on any public-facing card.

- Use alternate IDs for daily needs whenever possible.

Being cautious with your SSN can help you avoid major headaches down the line. It’s not just a number—it’s tied to your entire financial identity.